FILING YOUR 2020 TAX RETURN (TAX SEASON 2021)

The 2021 tax filing season is upon us. Every year, we see changes in the tax code and important new information to share with our clients. But this year stands out.

Due to the COVID-19 pandemic and related stimulus, there are many new factors individuals and businesses need to be aware of. Fortunately, almost all these factors are likely to benefit your 2020 tax returns.

Our team at CG Tax, Audit & Advisory has been closely following the tax implications of these stimulus measures, and we’re prepared to answer any related questions.

Below we’ve outlined the most important information you should know before filing. Information for businesses is immediately below. Please scroll down to read current tax filing information for individuals.

For more details, or if you have any additional questions, please contact us to speak directly with a Cg tax professional.

Tax Implications of Coronavirus Relief and Related Legislation

In March and April of last year, the federal government passed a wave of stimulus packages, including:

- The Coronavirus Preparedness and Response Supplemental Appropriations Act (now known as “Phase One”)

- The Families First Coronavirus Response Act (FFCRA)

- The Coronavirus Aid, Relief, and Economic Security (CARES) Act

On December 27th, 2020, a fourth stimulus package, the Consolidated Appropriations Act (CAA) was passed. On March 11th, 2021, a fifth, the American Rescue Plan Act (ARPA) was signed into law. Though ARPA was passed in 2021, it included retroactive measures that apply to tax year 2020 (some of which will lead to a refund later this year, if you filed your taxes before the bill was passed).

Tax Implications for Businesses

The most important stimulus measures for businesses, related to 2020 tax returns, include the Paycheck Protection Program (PPP), the Economic Injury Disaster Loan (EIDL) program, the Employee Retention Credit (ERC), and mandates for sick leave and family leave payments outlined in the Families First Coronavirus Response Act (FFCRA).

Paycheck Protection Program & Economic Injury Disaster Loans

The Paycheck Protection Program (PPP) was one of the first and most important pieces of legislation passed in 2020 to keep businesses afloat and their employees receiving income. In addition, the Economic Injury Disaster Loans (EIDL) program included grants and forgivable “loan advances”, both up to $10,000. (Any amount beyond $10,000 acts as a regular loan with a 30-year payment period.)

Tax-free and Tax-deductible

If you had previously worried about paying taxes on these stimulus payments, you can breathe a sigh of relief.

Initially, the IRS’s stance was that expenses paid by these loans should not be deductible. However, the Consolidated Appropriations Act (CAA) passed in December made funds from both PPP and EIDL entirely tax-free. Therefore, they are not considered taxable income, and expenses paid using those funds are fully tax-deductible.

PPP Audits

The IRS recently announced that all businesses that received PPP loans over $2 million will be audited to ensure the funds were spent properly. Many businesses that received smaller loans have also been subjected to audits.

Don’t worry. If your company is subject to an IRS audit, be proactive, make sure your records are in order, and if you need extra help, give us a call. We can help defend and represent your business during an IRS audit.

Employee Retention Credit (ERC)

The Employee Retention Credit (ERC) was another provision passed in 2020 to help businesses keep employees on their payroll. It allows employers to claim a credit on their 2020 tax returns, equal to 50% of wages paid to employees between March 13th and December 31st, 2020, up to $10,000 per employee (making the maximum 2020 tax credit $5,000 per employee).

However, unlike PPP and EIDL funds, expenses paid with ERC funds are not tax-deductible. This “expense disallowance” occurs retroactively and applies to your 2020 tax statement. For example, if you receive a $5,000 ERC for paying an employee $30,000 in 2020, you will effectively only be able to deduct $25,000 of that payment as an expense on your upcoming tax return. Nonetheless, the net effect or the ERC will be a benefit for your 2020 tax returns.

Families First Coronavirus Response Act (FFCRA)

The Families First Coronavirus Response Act (FFCRA) required employers with fewer than 500 employees to compensate their employees for certain work absences related to COVID-19. To incentivize employers to comply, the FFRCA included various tax credits related to these payments.

Sick Leave Payments

The FFCRA requires employers to pay employees during sick leave at their regular rate of pay, up to 10 days (80 hours) at $511 per day. In other words, $5100 was the maximum amount employers were legally required to pay, per employee who took sick leave in 2020. The full amount of these payments can be reimbursed on your 2020 tax returns.

Family Leave Payments

If employees had to take off work to care for a sick family member or a child whose school was closed due to COVID-19, then employees were required to pay them at least two-thirds of their regular pay, for up to 10-weeks. The maximum payment required by the law was $200 per day or a total of $10,000 per calendar year. These payments can also be fully reimbursed through a tax credit on your business’s 2020 tax returns.

Health Plan Payments

There are additional tax credits available to employers who chose to enact new healthcare benefits to cover the FFCRA’s sick and family leave payment requirements. These tax credits help cover “allocable health plan payments” on a sliding scale.

Read here for additional resources on FFCRA-related questions.

Tax Implications for Individuals

The most important stimulus measures related to individuals’ 2020 tax returns include unemployment benefits and recent changes to the Child Tax Credit (CTC).

Unemployment Benefits Taxation Changes

Under normal circumstances, unemployment income is fully taxable as regular income. This would have been the case for unemployment income received in 2020, until the passage of the American Rescue Plan Act (ARPA) on March 11th, 2021.

According to the new bill, the first $10,200 of unemployment income ($20,400 if married filing jointly) is tax-exempt for individuals who earned a total (or “modified adjusted gross”) income of less than $150,000 in 2020.

Those who filed their taxes before ARPA was passed, in March, 2021, can expect a tax refund in the spring or summer of 2021 to compensate for the “deduction”, according to a recent IRS announcement.

Child Tax Credit (CTC)

The most recent stimulus package, the American Rescue Plan Act (ARPA), contained good news for taxpayers with children, including individuals earning up to $75,000 and couples earning up to $150,000. It expanded the Child Tax Credit.

Expanded CTC Funding

The Child Tax Credit previously provided parents $2000 per child. ARPA has expanded the Child Tax Credit to $3,000 per child under age 18 and $3,600 per child under age 6, for the 2021 tax filing season.

The CTC is Now Fully Refundable

Previously the CTC was partially refundable, meaning the full amount could be subtracted from taxes owed but only a portion could be included in a tax refund. ARPA made this year’s CTC fully refundable, so taxpaying parents will receive the full amount, whether it’s a subtraction from taxes owed or an addition to their tax refund.

The expanded CTC currently applies only to the 2021 tax filing season. However, lawmakers are looking into ways to make this change permanent.

When can I expect my tax return to arrive?

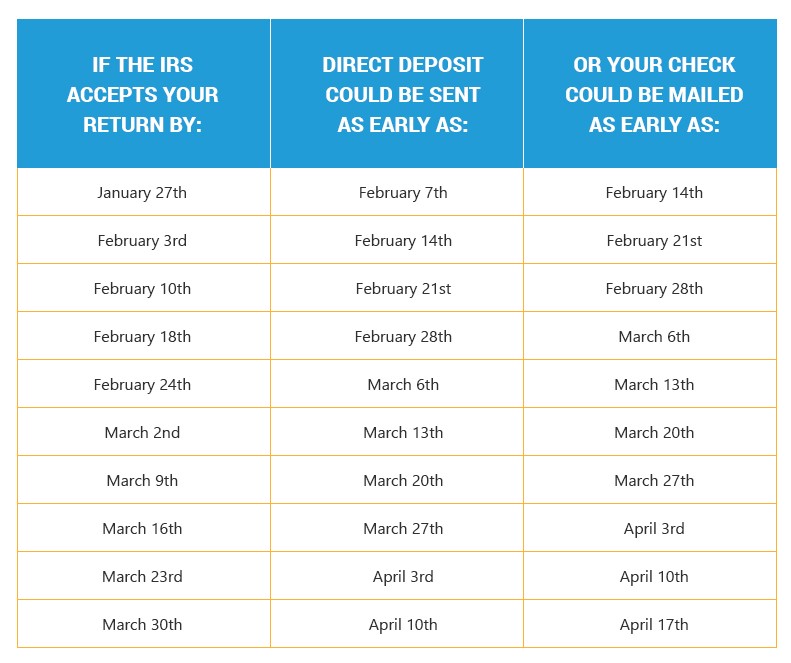

Below is a table describing anticipated timelines for tax returns, based on the date when you file.

Note that the tax deadline for individuals has been extended from April 15th to May 17th. If you’re working with Cg, our goal is to proactively complete all returns, so please reach out to your Cg accountant as soon as possible.

Get Professional Assistance on Your Tax Returns

To learn more, view our guidelines from the 2020 filing season (2019 tax returns), which cover changes regarding IRS Form 1040 and the Tax Cuts and Jobs Act of 2020. Or view our COVID 19 resource center.

And of course, you can always contact our team to speak directly with a Cg tax expert and get professional assistance on your 2020 tax returns. We look forward to helping you navigate this tax season.